User research aims to find ways to enhance the customer experience so you can sustain high customer satisfaction and retention throughout the customer journey.

The gathering of insights from the customer journey starts as early as customer onboarding—the first (and arguably most important) experience customers get from your company. And without effective onboarding, collecting proper insights that’ll help you grow long-term is difficult.

After all, failing to educate customers early on might make it challenging for them to engage with your product. In fact, they may just choose to not engage with it altogether.

AppsFlyer’s 2023 uninstall report backs that up, showing how nearly one in two apps ends up getting uninstalled before the 30-day mark. And out of those that get uninstalled within 30 days, 49% of uninstalls occur within the first 24 hours.

You can partly attribute these drops to the impression clients get from your onboarding process. When you don’t proactively educate customers on how to use your product, they’ll start developing problems that result in a negative first impression.

When these problems become repetitive, they can quickly escalate to be the biggest source of a customer’s pain point, which affects their customer experience. That puts you in danger of losing current clients and potential future customers.

Improved Onboarding Leads to Better Insights

The first step to improve your client onboarding process is to lay out all the onboarding steps from start to finish.

- What milestones will you monitor?

- Who are the stakeholders, and what’s their role in the client onboarding process?

- What do you need the customer to do?

- Which specific capabilities or features do customers want to know more about?

- When will you complete the onboarding process?

Organize these details in a way that both the customer and yourself would understand.

Then, you can use customer onboarding tools like GUIDEcx to help you streamline the onboarding process with automated task reminders that move everyone through the process efficiently. Anyone (including your customers) should be able to access the system anytime and see exactly where everything stands.

That level of predictability, visibility, and transparency reduces anxiety for customers and keeps them in the loop on what’s happening, improving the customer experience and making them more likely to stay.

Once you nail down the onboarding process, you’ll be able to achieve long-term success and collect better insights, thus enabling you to look into and make improvements to other facets of the customer journey.

But what does that look like?

Conducting Research To Uncover Customer Insights

There’s a lot to consider when conducting user research. Depending on the question you are trying to answer and the data you need, there are many methods to consider to uncover the most beneficial information from users.

When beginning a round of research, it’s important that you first understand the problem you’re trying to solve, and, then based on that problem, choose an appropriate research method.

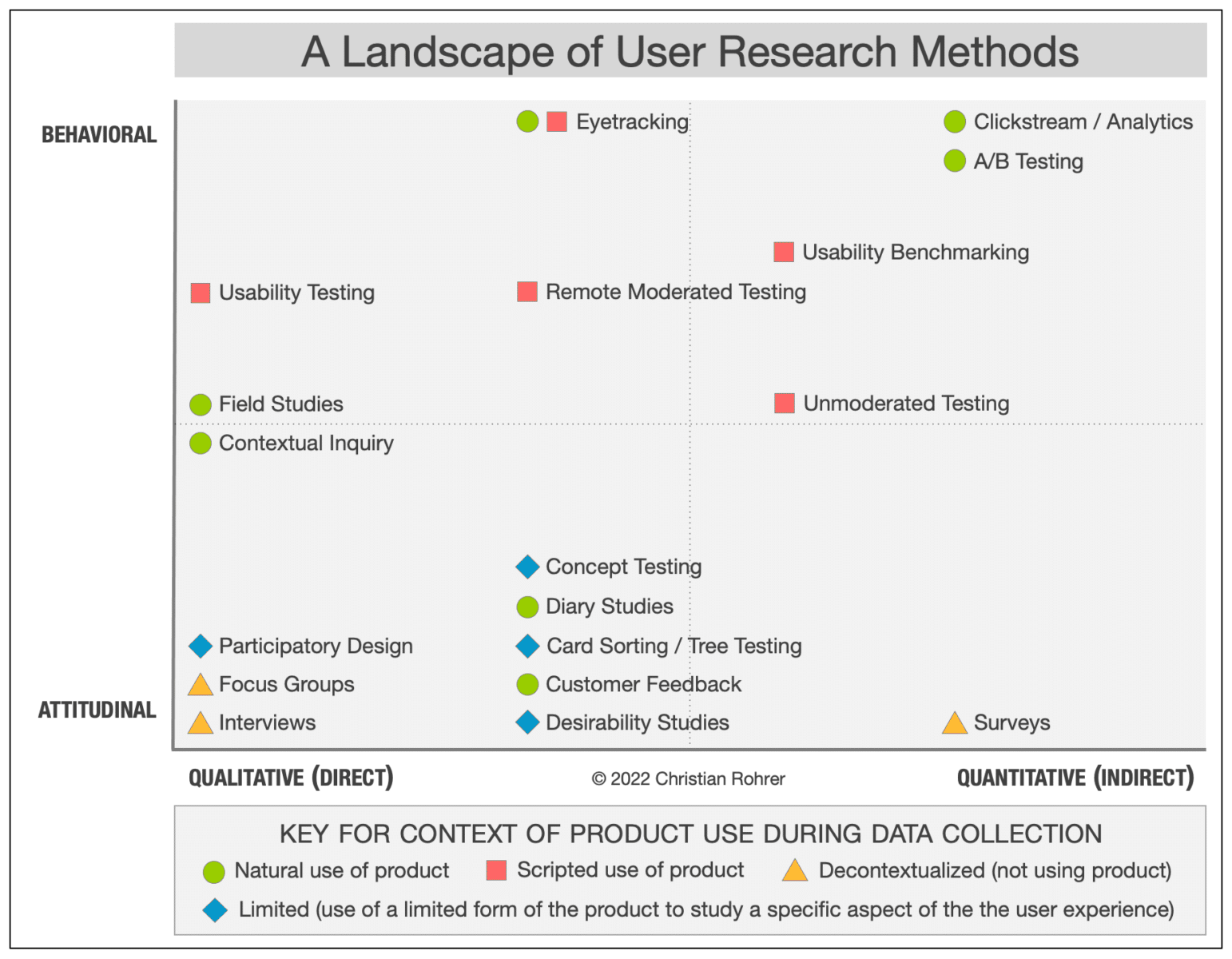

Based on Christian Rohrer’s model, the chart below helps researchers determine what research methods to use based on what they’re trying to figure out.

On the X-axis, you’ll notice the two ends are qualitative and quantitative. Studies that are qualitative in nature generate data based on observing a person or thing directly, whereas quantitative data is gathered indirectly, like through a survey or analytics tool. Qualitative research methods are suited for answering questions about why or how to fix a problem, whereas quantitative methods answer how much or how many types of questions.

On the Y axis, the two ends are attitudinal and behavioral. Attitudinal can be characterized as what people say, vs behavioral, which can be characterized as what people do. According to Christian Rohrer, the purpose of attitudinal research is usually to understand or measure people’s stated beliefs, which is why attitudinal research is used heavily in marketing departments. In short, behavioral tells you what’s happening, and attitudinal tells you why it’s happening.

The type of research you’ll do will depend on the insight you are trying to uncover, as well as the stage of development for your question. Keep in mind that you may need to use a couple of different research methods depending on the scope of your question.

Let’s go through the various research methods, and where they lie on the graph. In this article, we’ll go through the most common ones, including:

- Exploratory interviews

- Support call shadows

- Listening labs

- Card sorts

- Surveys

- Benchmark studies

In the early stages of your research, you’ll probably be looking for answers to questions like:

- What do people need?

- Where are they starting?

- What’s working and what’s not?

The best way to uncover these answers is through exploratory interviews and support call shadowing.

Exploratory interviews

Exploratory interviews are in-depth discussions with users to uncover thoughts, problems, or solutions. Your interview should be made up of an introduction where you set expectations with the user about how the interview will go; background questions to further build trust and rapport. Background questions also help the interviewer set up for the call, suss out any additional context that will be helpful to know, and finally, key research questions to help you understand the insights you’re after. When conducting interviews, there are a couple of things to keep in mind:

- There are no wrong answers. Establish in the very beginning that your goal is simply to understand their perspective.

- Avoid jargon. Make your interviewee feel comfortable by speaking in terms you both understand.

- Ask one question at a time. It can get really confusing for a respondent to hear a sentence that has several different questions in it. Oftentimes, this results in the respondent only answering one part of the question.

- Ask open-ended questions. Instead of, “Did you have a nice day?” where the respondent can give a simple yes or no, ask, “How would you describe your day?”

- Be mindful of tone. If you want more information from them, ask, “what else?” instead of “anything else?” Anything else is a good probe to ask if you’re trying to wrap up the question you’re asking.

Support call shadows

Support call shadows—as its name suggests—are when researchers shadow the support or customer success teams. Arguably, support agents are the folks who are closest to the customer. By shadowing support reps, you’re gaining information about customers’ needs, their issues, and potential fixes. Contact your support team and see if you can actively observe your support team members answer emails, calls, or live chats. If this isn’t available, ask for a record of previous support cases that you can comb through on your own time.

As you gain more information through interviews and support call shadowing, the next step is to validate some of your findings, appropriate research methods include listening labs, card sorting, and surveys.

Listening labs

Listening labs are when a researcher engages in completely observational, uninterrupted natural use of a product that fits the current context and need of the participant, paired with a “think aloud” protocol. Let’s take an example of conducting a listening lab in order to find out how folks use a coffee shop app. Ask your interviewee to think aloud and tell you what they’re thinking as they complete a task. Give your interviewee a vague task, for instance: order a drink. When they’re doing their task, make sure to ask them questions like:

- What do you think of that?

- What are you looking for?

- What do you expect that will do?

After they’ve completed their task, ask them questions like:

- How does this experience compare to what you want to do?

- What do you like and dislike?

- What are 3 things you would do to improve this product?

Listening labs are best used for walkthroughs of apps, websites, product tests, and anything that involves your customers completing a task. If possible, record your session. Listening labs typically take about an hour. After you’ve finished running a few, have your team watch the labs, taking notes about what they notice.

Card sorts

Card sorts are when participants place information into categories that make sense to them and group them accordingly. To conduct a card sort, you can use actual cards, sticky notes, or online card sorting software, like Miro. Card sorting is useful in two scenarios:

- When you want to discover how people understand and group concepts

- When you want to improve the existing design or create a new design

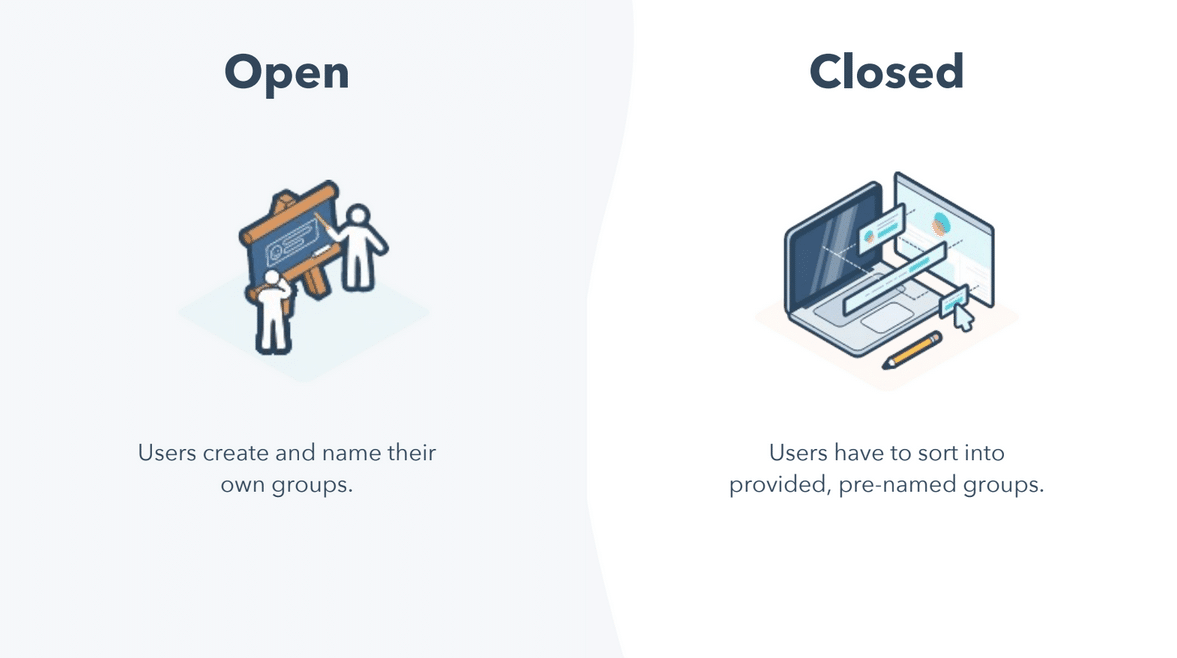

Card sorting can be open, allowing users to create and name their own groups, or closed, where users have to sort into provided pre-named groups. Open card sorting is best when you want to design something completely new, like a website or a blog. Closed card sorting is best when you’re simply looking to improve or prioritize features.

Surveys

Surveys are structured questionnaires that your target audience completes over the internet generally through filling out a form. Use surveys when you need low-cost, quick, quantitative feedback to validate or invalidate a small assumption. Surveys best uncover ‘how much’ or ‘how often’ type answers.

When writing your survey, keep in mind the following:

- Keep it simple. A survey should take 5 minutes or less, meaning the number of questions should be under 15. Keeping it under 10 is even better. You should also try to limit the number of pages in your survey. Each added page will increase the drop-off rate of respondents.

- Include only necessary questions. Ask yourself what you would do next with the learnings from each question. If the answer is ‘nothing’ or ‘it’s interesting to know’, leave the question out.

- Order matters. Add easy questions to the beginning, goal-oriented questions in the middle, and sensitive questions at the end.

Benchmark studies

When you have a good idea of what the majority of folks are saying and looking to push an idea live, benchmark studies can come in handy.

Benchmark studies are usability studies that are conducted over time with multiple participants to compare metrics such as time on a task or success rate. This ensures your ideas are on the right track to improving your customers’ experiences.

When conducting a benchmark study:

- Choose what to measure. Focus on key metrics that best reflect the quality of the experience you’re interested in evaluating. This could be happiness, engagement, adoption, retention, etc.

- Collect your first measurement to establish a baseline.

- Put into place your ideas. Remember, you will only have meaningful results if you change what you’re testing.

- Collect additional measurements. There’s no rule on how long to wait after a design is launched to measure again. For products, 2-3 weeks can be a good start.

- Interpret findings. Generally speaking, you’ll need to use statistical methods to see whether any visible differences in your data are significant.

Finding research participants is hard, and it may help to incentivize respondents with swag, gift cards, free onboarding sessions, or something of the like to increase sign-ups. If you don’t have the means to provide incentives, get creative! Talk to your customer-facing teams to find out if there are any customers who’d be willing to chat with you, or even scour social media to see if folks are actively talking about your brand.

Armed with the appropriate research methods, you’re ready to go out and understand your customers a bit better. Good luck!

Analyzing and Applying Customer Research

After you’ve collected your research on the aspect of the customer experience you want to improve, the next step is to analyze and apply the research.

When analyzing your research, we suggest using a thematic analysis approach. Thematic analysis is a qualitative data analysis method that involves reading through a data set (such as transcripts from in-depth interviews or focus groups), and identifying patterns in meaning across the data to derive themes.

For example, during the onboarding process, you can gain valuable data from the onboarding software, such as customer response, adoption, and churn rates. Reading through the data, you can identify meaningful patterns like how often new customers use your product and which features they want to learn about most.

One of the best parts about a thematic analysis is that it’s a flexible approach that’s beginner-researcher friendly. Folks who are just learning how to analyze data will find this approach fairly accessible.

Six steps to conducting a thematic analysis:

- Familiarize yourself with the data. Transcribe your interviews. Comb through your surveys. This is most likely too much work for one person to do, so make sure you have other folks who are willing to help. Plus, depending on how much data you have, it’s possible one person might accidentally miss important information.

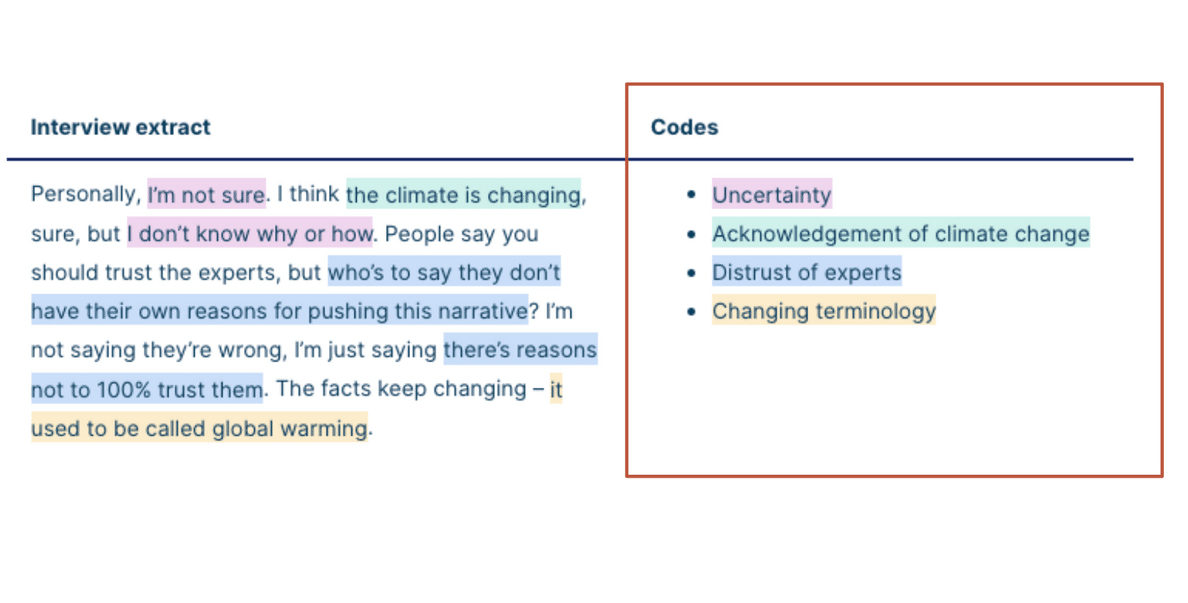

- Code. Coding means highlighting sections of the information and coming up with shorthand labels, or codes, to describe the content. For example, let’s take an excerpt from this interview, taken from Scribbr.com. Here, our codes are uncertainty, acknowledgment, distrust, and changing terminology. At this stage, it’s important to be thorough: go through all of the data and highlight everything that seems relevant or interesting.

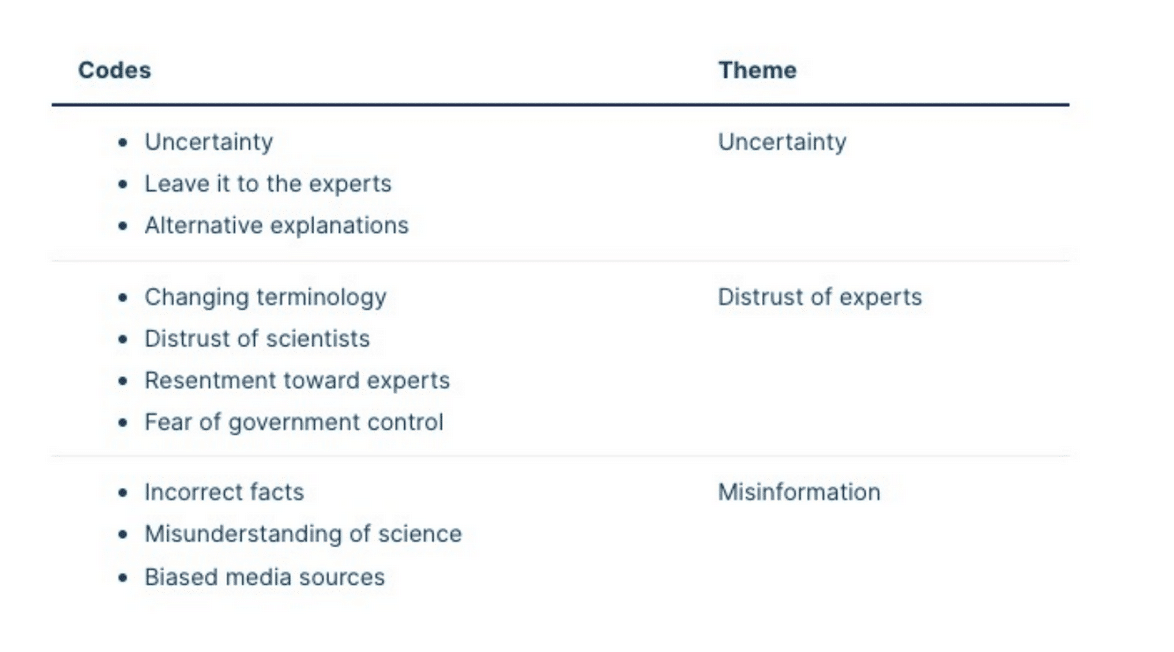

- Group codes into themes. Once you’ve coded, look through the codes you’ve created and try to identify themes among them. Themes are broader than codes. Most of the time, several codes will roll up into a single theme. For example, here, the codes of uncertainty, leaving it to the expert, and alternative explanations all roll up to the theme of uncertainty. In this stage, you might find that some of your codes aren’t as relevant as you thought, and some codes might be themes in and of themselves. That’s ok, feel free to adjust your codes as you see fit.

- Review and revise themes. This stage requires you to ensure your themes are useful and accurate representations of the data. Are you missing anything? Are the themes actually present in the data? Do any themes need to be split up or discarded? Can you change any naming to make the themes work better?

- Define your themes. Your themes should be so clearly defined that anyone in your company can understand what your theme means. For example, in the theme “distrust of experts,” it might be worth further defining experts. You may want to reword a theme like this to “distrust of authority” or something you think your audience may prefer.

- Write your narrative. Writing your narrative is the final step to telling the story of your data. Your write-up should include:

- An introduction to communicating your research question, aims, and approach.

- A methodology section describing how you collected your data.

- A results section that addresses each theme you found.

- A conclusion that explains the main takeaways and shows the answer to your initial research question.

Make sure your writing is accessible to your entire company. If you have an internal forum such as a Wiki, consider posting it there.

Apply your insights

The last step in wrapping up your research is arguably the most fun: applying your insights. The data and analysis you’ve done can have major effects on the future of your company. The analysis will help you form strategies, drive sales, develop products, and improve the customer experience. According to Christina Bailey, author of customer insight strategies, there are six steps that outline how your insights can be used.

- Understand. Use your analysis to develop a deep understanding of your markets, competitors, and customers, including their future needs, pain points, and behaviors.

- Develop. Read and reread your thematic analysis write-up. Use that document to develop strategic marketing plans and programs.

- Tailor messages to customer segments. Use your analysis to decide what type of content or offer should be serviced to a particular customer.

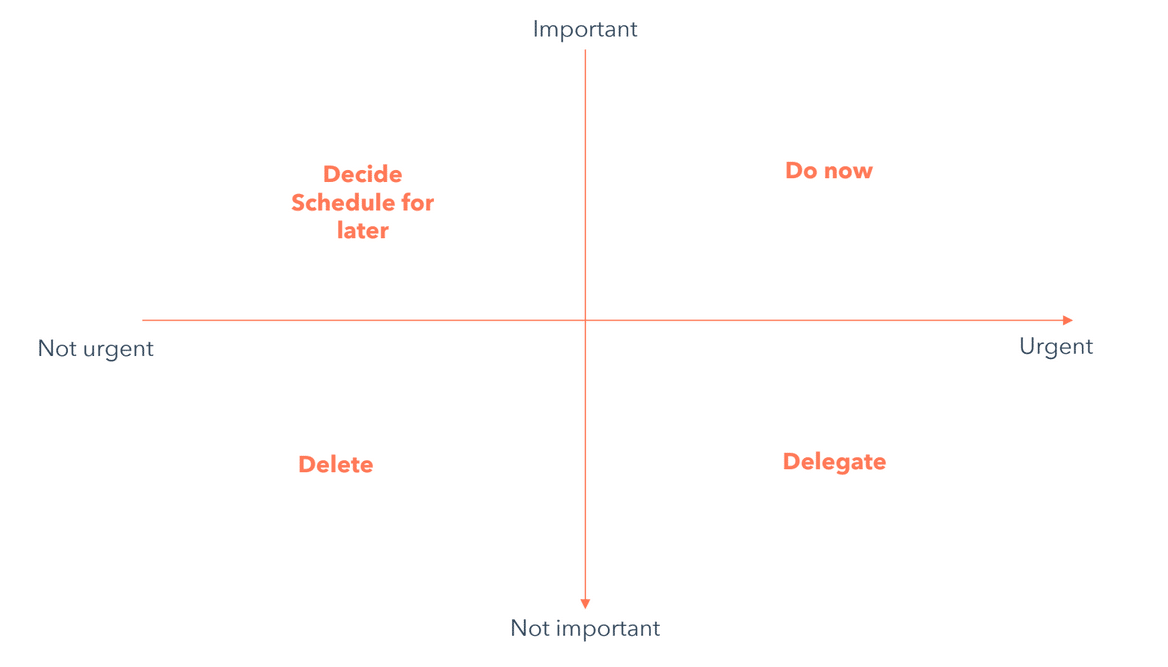

- Prioritize. Figure out what you need to do, what you can delegate, and what can wait. If you need a helpful way to prioritize, use the Eisenhower box. Things that are important and urgent are what you should focus on today. Things that are important but not urgent are critical but not immediate; this is something you should schedule to do. Things that are urgent but not important: delegate. Who can do this for you? And finally, things that are not important and not urgent are things you can forget about.

- Position conversations. Analyzing your customers’ behaviors will help you get the right messages at the right time through the right channel.

- Measure. This process isn’t a one-and-done. Measure the results of your marketing efforts to continually improve. For instance, run benchmark studies whenever you implement a change, big or small. Send out NPS surveys quarterly. The only way to convince others is to have numbers to back up your ideas.

By using your analysis to understand, develop, tailor, prioritize, position, and measure, you’re turning your insights into action so you can better acquire, develop, and retain customers.

Adriti Gulati, HubSpot

About the Author:

Adriti is currently an Inbound Professor for HubSpot Academy, focusing on Service Hub. Prior to HubSpot, Adriti worked at a non-profit educational program focusing on getting high school students into colleges and universities. She is passionate about ensuring education is accessible for all. Outside of work, Adriti can be found at your local Chinese restaurant, or a spin class, trying to work off said Chinese food. Follow Adriti on Twitter.

Talk With a Guide Today

Discover how GUIDEcx can help you improve efficiency by reducing your customer onboarding timeline and increasing the capacity of your project managers. Our unparalleled professional resources and unwavering commitment to excellence support our industry-leading customer onboarding solution.