Client Onboarding:

We Work, Where You Work

It may sound simple, but collaboration, communication, and transparency must occur for this onboarding process to succeed.

What is Client Onboarding?

Client onboarding is similar to employee onboarding but has some key differences. Client onboarding is external, while employee onboarding is internal.

Here’s a graphic of the difference:

Client onboarding can also be referred to as customer onboarding. Basically, if Company A has a product they sell to Company B, client or customer onboarding is the training and education Company A provides to Company B on how to use that product or service. Pretty simple, right?

Why is Client Onboarding Important?

Remember Companies A and B from above? Let’s refer back to those two.

Client onboarding is important for Company A because when it’s done well, it helps them build trust and loyalty with their customers. It can help them grow as a company, reflecting their support. If their support to their clients is poor, the reputation of providing poor service will return to them.

For Company B, client onboarding helps them learn how to use the product or service to its fullest extent. This means there’s a greater chance of them becoming loyal customers.

Overall, client onboarding benefits both the sellers and buyers of a product or service. It’s an often overlooked process, and when buyers feel like they’re being ignored or forgotten about post-sale, there’s a much higher risk they’ll churn. Here’s some great info on the difference between B2B and B2C churn, why it occurs, and how to solve it.

4 Keys to Prepare for Successful Client Onboarding

GUIDEcx Client Onboarding Features

Our platform includes powerful tools and features designed specifically to support customer onboarding.

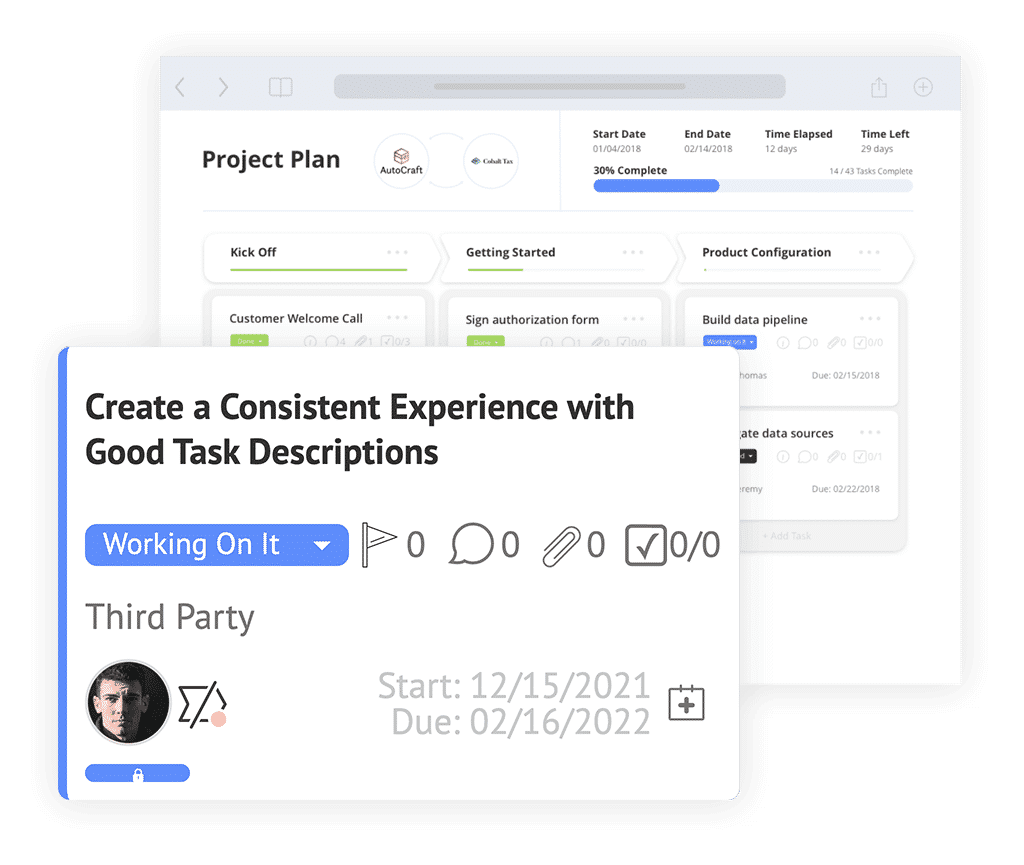

Streamlined Workflows and Task Management

Our project management and task management tools offer multiple project views, including List View, Gantt View, and Board View.

These views allow you to visualize your project timeline, simplify project reviews, make adjustments, and gain insights into how project elements fit together. Dive into the details of your project using our Task View, where you can create task groups, assign participant tasks, and add task watchers for enhanced accountability.

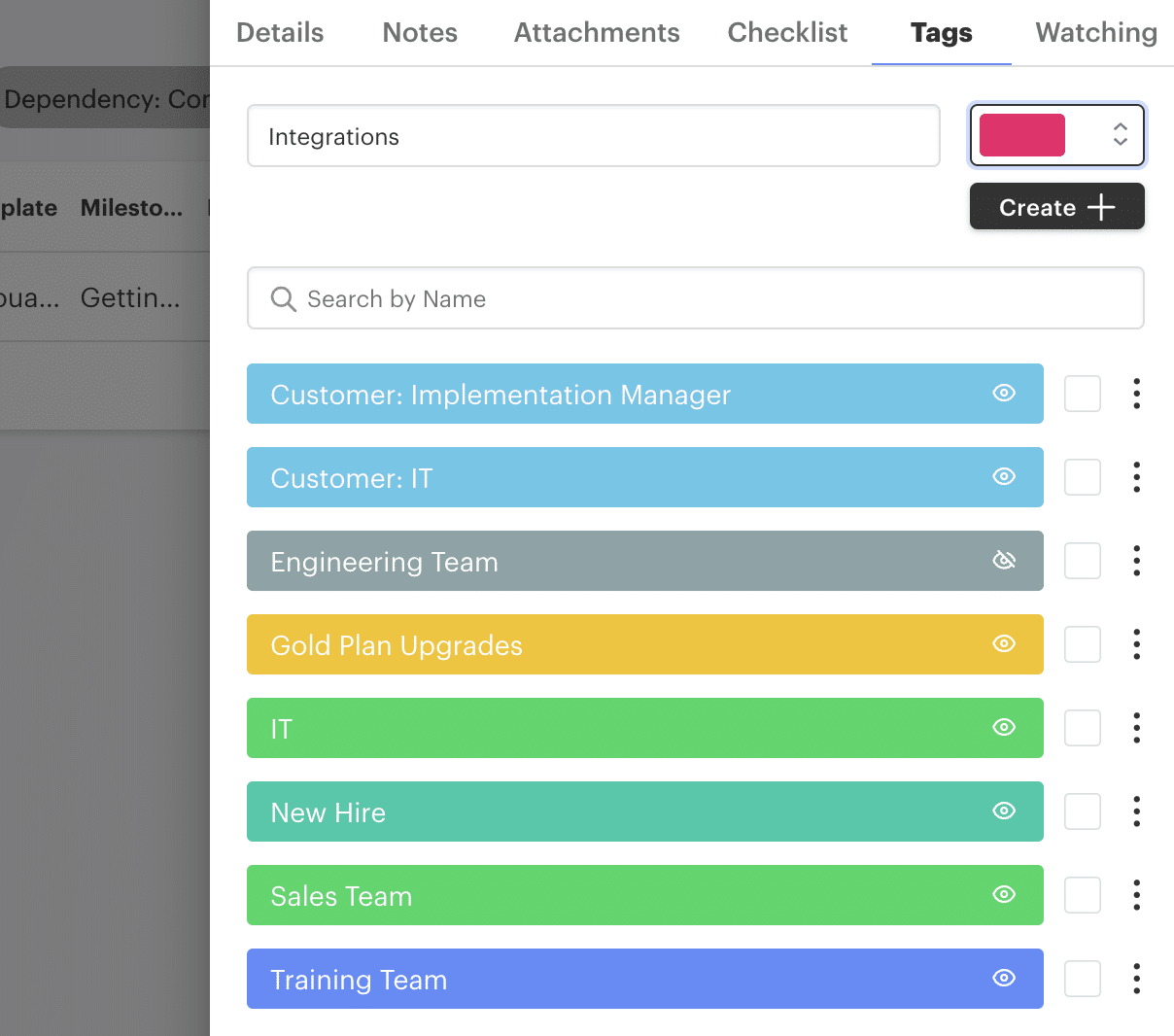

Efficient Organization with Tags and Filters

GUIDEcx lets you stay organized and maintain oversight through our tags and filter features. Create custom tags for projects or tasks, which can be used to filter, organize, and bulk assign and edit items.

Additionally, save commonly used filters based on status, company, assignee, timeline, and more for quick navigation and easy oversight.

Manage Projects On-The-Go with Mobile App

GUIDEcx’s mobile app lets you stay connected and productive while on the go. Update project or task statuses, respond to customer notes, and easily upload attachments.

Enable push notifications to ensure you never miss important updates, keeping you informed and engaged with your project management responsibilities.

Don’t Take Our Word For It. Hear From Our Customers

Powerful, Purposeful, Seamless Integrations

GUIDEcx offers robust integrations with over 1,000 applications, allowing you to increase automation and simplify project management. Seamlessly connect your existing tools and systems to GUIDEcx, enabling efficient data exchange and reducing customer manual efforts.

GUIDEcx is Leading the Client Onboarding Software Category

Our customers love us for our customer service and how we enable our users to engage their customers. See how we specialize in customer onboarding, task management, workflow management, and project management.

We GUIDE The World’s Leading Brands:

Over 300,000 projects completed on GUIDEcx.

Talk With a Guide Today

Discover how GUIDEcx can help you improve efficiency by reducing your customer onboarding timeline and increasing the capacity of your project managers. Our unparalleled professional resources and unwavering commitment to excellence support our industry-leading customer onboarding solution.